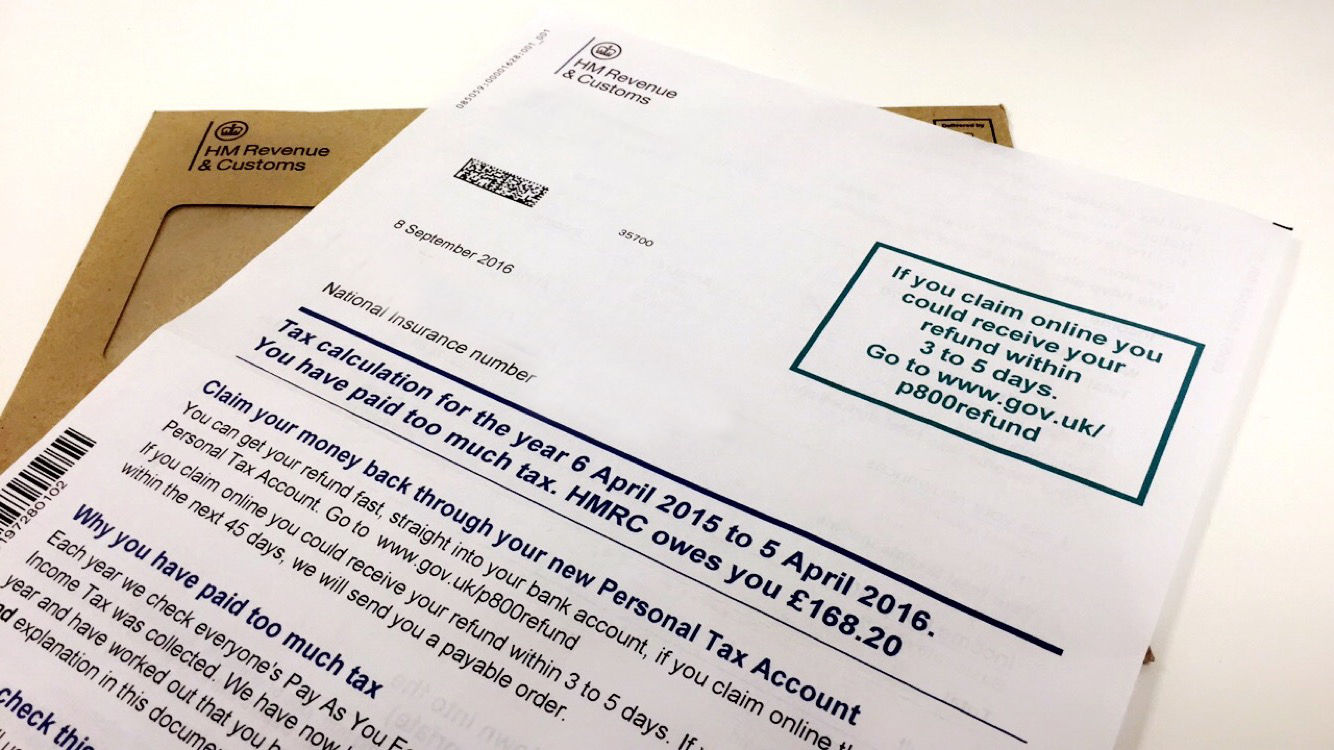

What is a P800 Tax Form/Letter?

A P800 is also known as a tax calculation and shows the breakdown of all your taxable income and tax paid.

Your P800 form will highlight various aspects that influence your tax payable or repayable over the Tax year. The P800 Form is broken down into the following areas:

Your P800 form will highlight various aspects that influence your Tax payable or repayable over the Tax year. The P800 Form is broken down into the following areas:

- Income – This would typically be earnings from employers for the job or jobs you have worked in for a particular tax year.

- Deductions – These would be Tax-deductible expenses or allowances, for example, Flat Rate expenses for certain jobs, mileage (if you have had travel to carry out work duties as part of your job), or professional fees & subscriptions.

- Allowances – commonly this would simply be your annual personal tax-free allowance. For the current Tax year (6th April 2023 to 5th April 2024) this is £12,570.

- Adjustments – these would be manual adjustments created by HMRC but would commonly include overpayments or underpayments from previous years.

- Result – this is the final result of your P800 calculation, and this will be your tax rebate or liability. rebate or liability.

Is an HMRC P800 Tax Refund genuine?

Yes, the HMRC P800 Refund is a legitimate tax claim. You will only receive a genuine P800 Tax Form by post and HMRC will not text or email you to ask for any personal or financial details.

If in any doubt, do not enter any details or click on any attachments – the scams are pretty convincing.

Why would I receive a P800 Tax Form?

Not everyone receives a P800 tax calculation letter, but if you have made a tax rebate claim, HMRC will issue them to taxpayers who have paid either too much (meaning you are due a tax rebate) or too little tax.

You may also receive the P800 Form a few months after a tax year has finished (usually around August every year) and your tax payments are not completely accurate. This may be due to various reasons.

- Finished a job, started a new one, and were paid by both employers in the same month.

- Started receiving a pension at work.

- Receive certain benefits, like employment and support allowance or Jobseeker’s Allowance (JSA).

- A new FRE has been applied to your job.

Will Self-Employed Individuals Get a P800?

No, you will not get a P800 Letter if you’re registered for Self Assessment. P800 is applicable only for people working on payroll. Your bill will be adjusted automatically if you’ve underpaid or overpaid tax.

How is the P800 tax calculation done?

If you’re employed or get a pension, your employer or pension provider uses your tax code to work out how much tax to take from you.

You could still be paying too much or too little tax. For example, if you got a company benefit or pay rise that HMRC did not know about, and so they did not update your tax code.

If you have not paid the right amount at the end of the tax year, HMRC will send you a P800 Tax Form or a Simple Assessment tax calculation.

Your P800 Form or Simple Assessment will tell you how to get a refund or pay any tax you owe.

Is the P800 tax calculation always accurate?

Not necessarily – it is always worth checking, regardless of whether HMRC thinks you have underpaid or overpaid tax. Here is how to work out if your P800 tax calculation is correct:

- Check any P60s, P45s and P11D forms to ensure your P800 stacks up correctly against them.

- Make sure all other expenses, like mileage, pension contributions and, marriage allowance are also recorded.

What if a P800 Form says some tax is owed?

Here’s how HMRC will go about collecting outstanding tax:

- It will be taken off your paycheque monthly if you are employed.

- They will ask you to pay the amount directly.

If it is thought you owe less than £3,000, HMRC will adjust your tax code and collect that tax owed – over time – from your pay. Anything over this amount and the taxman will be in touch to organize a repayment plan.

How can you pay P800 tax online?

Your P800 Tax Form will tell you how you can pay the tax you owe online.

If the letter states you can, you will need to check how much income tax you paid in the previous year and follow the UK HMRC instructions.

What if the P800 says HMRC owes me money?

If you pay tax through the PAYE system you may sometimes pay too much tax and notice this by looking at your payslip or P800.

There are various reasons for this, but the most common is being given an incorrect PAYE /tax code or having an electable tax rebate applied to your annual tax accounts, such as Marriage Allowance or FRE.

If you think you have overpaid tax through PAYE in the current tax year, tell HMRC before the end of the tax year – April 5, 2023.

You have four years from the end of the tax year in which the overpayment occurred to claim an HMRC P800 tax refund.

If you have received multiple P800 Forms - How can you calculate the P800 Tax Refund you’re owed?

Sometimes you may receive multiple P800 forms, as HMRC may send out P800 forms for each tax year where you are liable for tax or owed a tax refund.

You should always look at the P800 Form for the most recent tax year for a final figure, as HMRC uses a rolling calculation and carries forward any tax owed or tax credit to the subsequent tax year(s), with the final amount showing in the most recent completed tax year calculation.

How can you claim a P800 Tax Refund from HMRC?

You can claim an HMRC tax refund by filling in Form P50. Send this to HMRC with parts 2 and 3 of your P45. Contact HMRC (0300 200 3300) before filling in the form and they will tell you what other information you need to provide.

If you need help with getting your P800 tax refund, you can also get in touch with us for Uniform Tax Allowance, Marriage Tax Allowance, and Mileage Tax.

How long does It take to receive the P800 refunds from HMRC?

HMRC P800 refund normally aims to send refunds out within 5 working days but sometimes takes a bit longer.

If you do not claim your refund online within 21 days, HMRC will send you a cheque. You’ll get this within 6 weeks of the date on your tax calculation letter or P800.

If you don’t receive a P800 Tax Form, does it mean you can’t claim a Tax Refund?

In these situations, HMRC’s P800 tax calculation system may mean you do not need to claim a repayment, as HMRC might issue a repayment automatically.

If you are yet to receive a P800 tax calculation from HMRC, and you have overpaid tax, you will need to claim a tax repayment.

Claim your P800 Tax Refund today

Do it Yourself

To claim the P800 tax refund, head to the UK government website and sign into your tax account using your Government Gateway User ID and password.

If you do not have a Government Gateway account, you will need to create one.

To create a Government Gateway account, you’ll need your National Insurance number and one of the following:

A valid UK passport

Payslip of last 3 months

Driving Licence issued by the DVLA (or DVA in Northern Ireland)

P60 form from your last employerInformation held on credit file if you have one.

Once you’ve made a successful claim, the money will land in your account within 5 working days

Trust a Tax Specialist

Claim My Tax Back is dedicated to helping ordinary employees and married couples (or in a civil partnership) claim back what they are owed from HMRC.

We’ve already helped thousands of people across the UK reclaim their tax rebates. Contact us today if you are struggling to understand P800 and you need an expert to take care of your tax refunds quickly.