Employer’s PAYE ref number

- Home

- Employer’s PAYE ref number

What is an employer’s PAYE ref number?

An employer PAYE reference is a unique combination of letters and numbers that HMRC assigns to a business when it registers as an employer. HMRC uses this reference to identify the business for employer PAYE purposes.

It is sometimes called an ‘Employer Reference Number’ (ERN), an ‘employer PAYE reference number’, a ‘Pay As You Earn reference number’, or a ‘PAYE reference’.

An employer PAYE reference consists of:

- a three-digit tax office number

- a forward slash (/)

- a tax office employer reference, which is a combination of characters (letters and/or numbers) unique to the business

It’ll usually look something like 123/A45678 or 123/AB45678 (though there can be exceptions).

The three numbers in the first part of the reference (before the forward slash) identify the specific regional tax office that deals with the employer’s PAYE affairs.

The second part of the reference (after the forward slash) identifies the particular business/employer.

Where can I find my employers PAYE ref number?

There are several places you can find your tax reference number. These include:

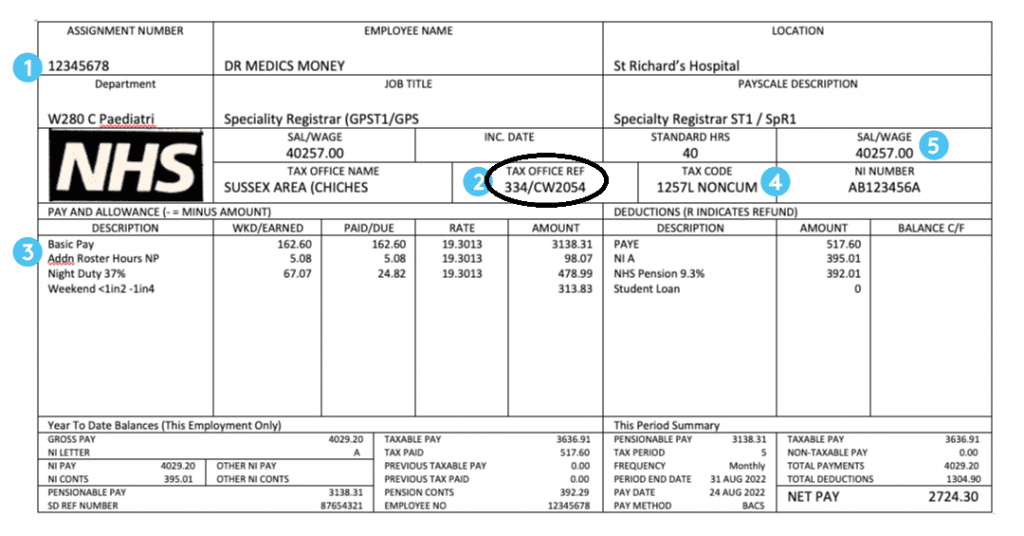

- A payslip from your employer

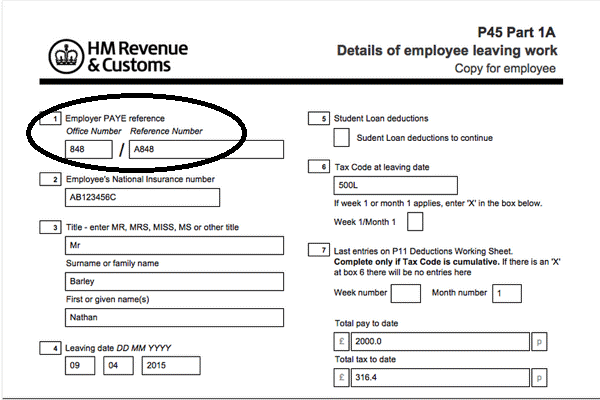

- Your P45 if you stop working for them

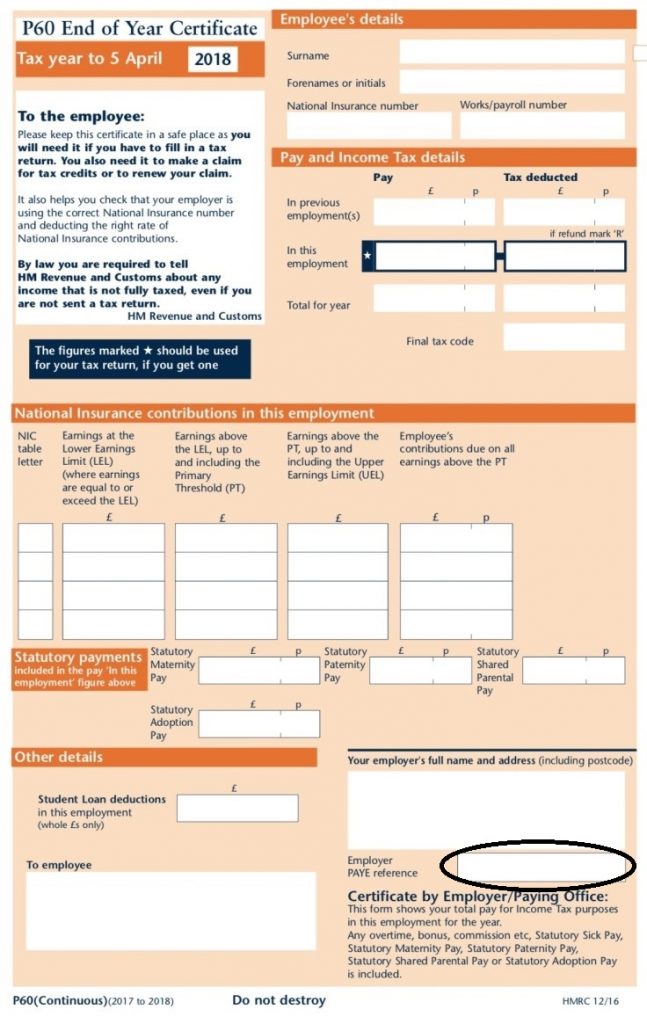

- On your P60. This document is issued at the end of each tax year, showing the total amount of pay, NI and income tax relating to that employer.

- Your Notice of Coding. This is the document HMRC provide to tell you which tax code is operated against your income from an employer.

- Your personal tax account with HMRC, Personal tax account: sign in or set up – GOV.UK (www.gov.uk)

- HMRC app, The free HMRC app – GOV.UK (www.gov.uk)

P45

WAGE SLIP

P60